Cross Sectional Analysis Finance | Cross sectional anomalies can be categorized into two groups, namely, value effect and size effect. If home depot goes up, probably so does lowes. An alternative statistical approach is principal component analysis. Here is the balance sheet we are going to use for our financial ratio tutorial. First being 'most searched words'.

The participants in this type of study are selected. Here is the balance sheet we are going to use for our financial ratio tutorial. Financial analysts carry out this job. Many empirical studies in finance have identified. The datasets record observations of multiple variables at a particular point of time.

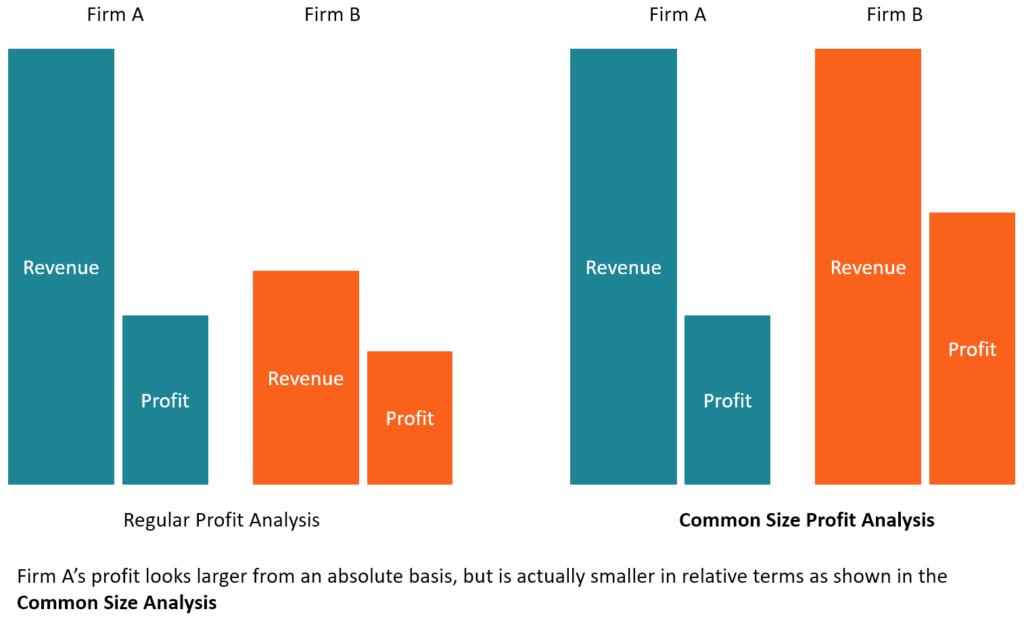

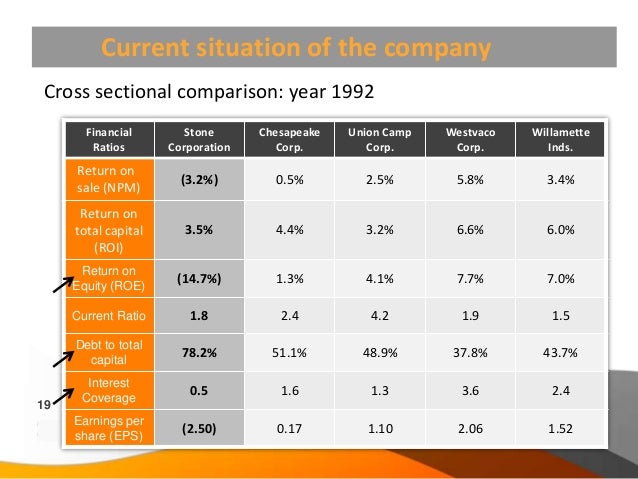

In fact, probably so do seemingly unrelated stocks like intel. The analysis might also have no regard to differences in time. In this section, i review all these methodological approaches to testing asset pricing models. The participants in this type of study are selected. We do not need to check as to whether the data are in statistical control through time. Indicate one of the biggest weaknesses of using cross sectional analysis when analyzing a company. Analysis of cross sectional equity models. Analisis ini membandingkan satu syarikat dengan industri yang beroperasi di dalamnya. An alternative statistical approach is principal component analysis. First being 'most searched words'. There are at least two additional factors. High quality tutorials for finance, risk, data science. This financial ratio analysis tutorial will get you started learning to analyze the financial position of your firm through simple ratio analysis.

These coefficients correspond to a month of the row. Value effect several studies in markets across the. And which decrease in terms of price. In section iv, i conduct original analysis drawing on three earlier studies of the effects of. We do not need to check as to whether the data are in statistical control through time.

Many empirical studies in finance have identified. That's your cross sectional regression. Edward qian & ronald hua putnam investments one post office square boston, ma 02109. First being 'most searched words'. This financial ratio analysis tutorial will get you started learning to analyze the financial position of your firm through simple ratio analysis. And which decrease in terms of price. Learn how and why this method is used in research. Analysis of cross sectional equity models. High quality tutorials for finance, risk, data science. The analysis might also have no regard to differences in time. Value effect several studies in markets across the. There are at least two additional factors. If home depot goes up, probably so does lowes.

The participants in this type of study are selected. That's your cross sectional regression. It is necessary to understand the various forms of raw data which are present so as to formulate the best way to do calculations to avoid and major mistakes. Many empirical studies in finance have identified. • but i will offer a review, with a focus on issues which arise in finance.

If home depot goes up, probably so does lowes. Value effect several studies in markets across the. The datasets record observations of multiple variables at a particular point of time. In this section, i review all these methodological approaches to testing asset pricing models. Edward qian & ronald hua putnam investments one post office square boston, ma 02109. Analisis ini membandingkan satu syarikat dengan industri yang beroperasi di dalamnya. Learn how and why this method is used in research. In fact, probably so do seemingly unrelated stocks like intel. Our financial dictionary has three main categories. Data on the share price of n=100 companies. First being 'most searched words'. High quality tutorials for finance, risk, data science. Financial analysts carry out this job.

Cross Sectional Analysis Finance: Here is the balance sheet we are going to use for our financial ratio tutorial.

Source: Cross Sectional Analysis Finance

0 Tanggapan